Bitcoin and crypto markets have been on a roll over the past 24 hours. It has been the largest move of the year so far adding $12 billion to total market capitalization as bitcoin price touches $8,000 again, but what has caused it?

The total crypto market cap has just hit a five-week high of $212 billion. Late November was the last time markets were this bullish but the following month saw them decline to a December 18 low of $175 billion. Since the beginning of the year, crypto-asset markets have gained 11.5%, or just over $20 billion, but it is still early days to call a rally just yet.

Bitcoin, as usual, has been one of the catalysts for the bullish momentum. According to Tradingview.com BTC lifted off from its intraday trading range around $7,500 to top out at a 47 day high of $8,000.

So far this year BTC has gained 9.5% and the past 8 hours or so have been most of it. There has been a slight pullback as usual from that psychological barrier but at the time of writing, bitcoin price was trading just shy of $7,900.

Fresh Capital Into Stocks and Safe Havens

The bitcoin bullish momentum appears to have been driven by a wider global flow of finance into stock markets and commodities such as gold and oil. Gold prices have hit a six-year high today according to the charts.

Ever since the US airstrike on Iranian targets, tensions have escalated and investors have turned to safe have assets, which now include bitcoin.

BTC Traders Not Tether

Recent research by IntoTheBlock indicated that the same few BTC are changing hands at this level which is why there has been no break above $8k. At the moment the markets are defying these findings as BTC bulls push that resistance zone harder.

After a six week consolidation period traders now seem bored in this low $7k range and pushed the king of crypto higher.

It was also recently reported that the Tether printers had fired up again as a spike in market cap on Coinmarketcap.com indicated. It was subsequently pointed out by Bitfinex CTO Paolo Ardoino that CMC had just included the USDT on the Tron blockchain and there was no new issuance.

. @coindesk please verify data accuracy before writing. CMC just fixed their data, no issuance here, no news. Redact or delete the article please… https://t.co/yVXmpVs9LJ

— Paolo Ardoino (@paoloardoino) January 7, 2020

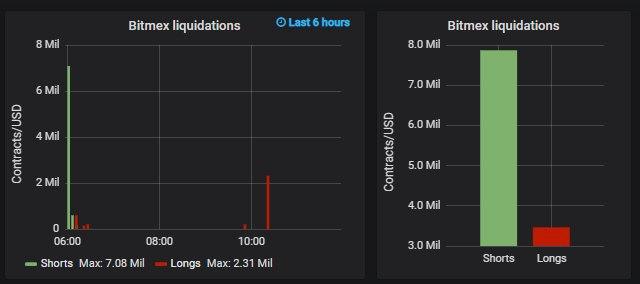

BitMEX Liquidations

Bitcoin price usually pumps when there has been a substantial liquidation of shorts on BitMEX. Looking at the data reveals that almost $8 million has been liquidated over the past 6 hours which has added to the momentum.

Where Next For Bitcoin Price?

Analyst and bitcoin proponent Tone Vays has eyed the next level of resistance around $8,300.

Trading #Bitcoin – $BTC Pumps to $7.8k where is resistance? is $8.3k next?https://t.co/lTQ9u7UACi

— Tone Vays [Vegas – Unconfiscatable.com] (@ToneVays) January 6, 2020

Using technical analysis in his video, Vays set up a couple of trend lines that were broken on shorter time frames. He compared this rally to the late November one adding that this pump alone is not enough yet to signify a longer-term bitcoin bull market.

He believes there is still a 60% chance of bitcoin price dropping back below $7k. The weekly chart is still not that impressive though and candles need to start closing above $8,500 for a real rally to be measured.

Will bitcoin price close above $8,000 this week? Add your comments below.

Images via Shutterstock, BTC/USD charts by TradingView, Datamish, Twitter: @paoloardoino, @ToneVays